Address

Email address

Phone number

https://motogate.eeAvaleht - Motogate

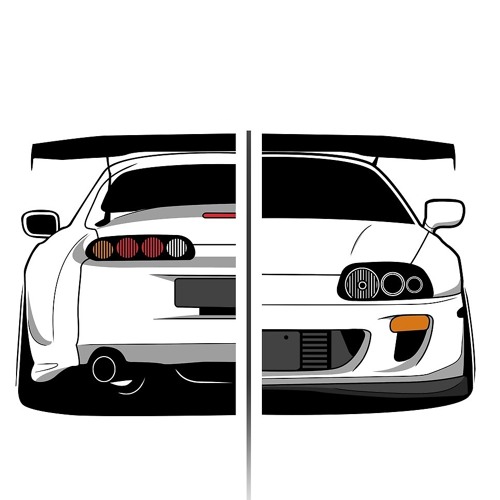

https://motogate.eeAvaleht - MotogateAutode import jaapanist Telli enda unistuste auto loe rohkem Saabuvad autod Viimased uudised

Name

Motogate osaühing

Registry code

11726591

VAT number

EE101331937

Type

OÜ - Limited Liability Company

Status

Registered

Foundation date

29.09.2009 (15)

Financial year

01.01-31.12

Capital

2 682.00 €

Activity

74901 - Other professional, scientific and technical activities n.e.c. 45321 - Retail trade of motor vehicle parts and accessories

-

-

-

-

-

-

-

No tax arrears

-

-

| Owner | Representative | Beneficial owner | Roles | |

|---|---|---|---|---|

| Madis Enok

| 33% - 894.00 EUR | Board member | - | |

| Tõnis Enok

| 33% - 894.00 EUR | Board member | - | |

| Rutt Enok

| 33% - 894.00 EUR | - | - |

| Owner | Representative | Beneficial owner | Roles | |

|---|---|---|---|---|

| Jõekodu Arendus OÜ 12593362 | 50% - 1 278.00 EUR | - | - |

| Turnover | State taxes | Labor taxes and payments | Employees | |

|---|---|---|---|---|

| 2024 Q4 | 250 414.67 € | 1 385.26 € | 11 281.21 € | 4 |

| 2024 Q3 | 260 230.46 € | 25 550.18 € | 12 123.17 € | 4 |

| 2024 Q2 | 281 992.53 € | 23 042.23 € | 11 082.66 € | 4 |

| 2024 Q1 | 180 608.32 € | - | 10 709.75 € | 4 |

| 2023 Q4 | 389 377.07 € | 12 441.05 € | 12 627.82 € | 3 |

| 2023 Q3 | 183 854.21 € | 12 667.01 € | 13 674.15 € | 3 |

| 2023 Q2 | 129 742.84 € | 19 238.56 € | 11 564.21 € | 3 |

| 2023 Q1 | 65 129.76 € | 5 178.96 € | 10 509.24 € | 2 |

| 2022 Q4 | 92 791.82 € | 17 931.27 € | 10 509.24 € | 2 |

| 2022 Q3 | 261 593.56 € | 20 637.27 € | 7 035.28 € | 2 |

| 2022 Q2 | 119 403.44 € | 21 474.58 € | 7 330.22 € | 2 |

| 2022 Q1 | 12 842.09 € | 1 988.09 € | 5 357.53 € | 3 |

| 2021 Q4 | 27 691.18 € | 8 933.02 € | 6 304.62 € | 1 |

| 2021 Q3 | 19 646.88 € | 5 025.66 € | 5 254.62 € | 1 |

| 2021 Q2 | 18 891.67 € | 5 025.66 € | 5 254.62 € | 1 |

| 2021 Q1 | 226 396.24 € | 40 718.52 € | 5 531.82 € | 1 |

| 2020 Q4 | 132 339.13 € | 22 399.04 € | 5 254.62 € | 1 |

| 2020 Q3 | 92 175.82 € | 15 262.27 € | 5 882.29 € | 1 |

| 2020 Q2 | 149 673.5 € | 36 598.7 € | 8 390.62 € | 1 |

| 2020 Q1 | 147 411.02 € | 28 038.03 € | 3 773.46 € | 1 |