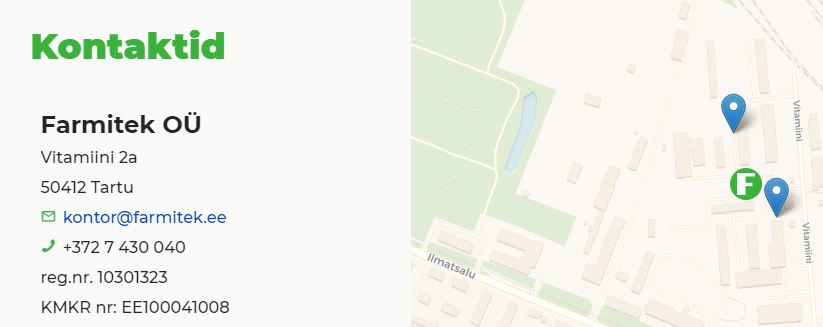

Address

Email address

Phone number

https://farmitek.eeFarmitek OÜ kontaktid

https://farmitek.eeFarmitek OÜ kontaktidFarmitek pakub seadmeid veisekasvatusele, linnukasvatusele, seakasvatusele, vedelsõnniku käitlemiseks ja sööda tootmiseks.

Name

Agrisilos OÜ

Registry code

11654354

VAT number

EE101301831

Type

OÜ - Limited Liability Company

Status

Registered

Foundation date

01.06.2009 (15)

Financial year

01.01-31.12

Capital

2 556.00 €

Activity

46191 - Agents involved in the sale of a variety of goods 41201 - Construction of residential and non-residential buildings 33201 - Installation of industrial machinery and equipment 77321 - Rental and leasing of construction and civil engineering machinery and equipment

-

-

-

-

-

-

-

No tax arrears

-

-

| Owner | Representative | Beneficial owner | Roles | |

|---|---|---|---|---|

| Raivo Paavel

| 100% - 2 556.00 EUR | Board member | - | |

| Erki Orav

| - | - | - | Founder |

| Rando Vink

| - | - | - | Founder |

| Owner | Representative | Beneficial owner | Roles | |

|---|---|---|---|---|

| H2Electro OÜ 16232422 | 1% - 25.00 EUR | - | - |

| Turnover | State taxes | Labor taxes and payments | Employees | |

|---|---|---|---|---|

| 2024 Q4 | 85 817.76 € | 2 247.49 € | 35.56 € | - |

| 2024 Q3 | 175 786.92 € | - | - | - |

| 2024 Q2 | 266 953.87 € | 5 373.77 € | - | - |

| 2024 Q1 | 73 563.6 € | 540.7 € | - | - |

| 2023 Q4 | 81 763.26 € | 2 686.84 € | - | - |

| 2023 Q3 | 162 456.63 € | 33 082.53 € | 87.16 € | - |

| 2023 Q2 | 304 728.05 € | 9 260.5 € | 5 204.25 € | - |

| 2023 Q1 | 209 703.54 € | 16 663.4 € | 5 348.27 € | 2 |

| 2022 Q4 | 405 825.16 € | 10 747.69 € | 8 065.47 € | 2 |

| 2022 Q3 | 320 549.06 € | 19 398.1 € | 4 784.39 € | 2 |

| 2022 Q2 | 326 364.64 € | 12 211.21 € | 11 820.95 € | 2 |

| 2022 Q1 | 64 467.08 € | 11 761.79 € | 11 202.99 € | 2 |

| 2021 Q4 | 134 928.68 € | 19 260.97 € | 7 758.02 € | 3 |

| 2021 Q3 | 255 005.09 € | 31 479.76 € | 8 824.35 € | 3 |

| 2021 Q2 | 274 882.93 € | 13 531.96 € | 4 003.87 € | 2 |

| 2021 Q1 | 233 087.26 € | 11 053.19 € | 3 781.51 € | 3 |

| 2020 Q4 | 206 135.28 € | 7 069.84 € | 4 167.91 € | 3 |

| 2020 Q3 | 190 814.84 € | 6 273.54 € | 5 047.8 € | 3 |

| 2020 Q2 | 282 157.31 € | 22 644 € | 3 454.03 € | 3 |

| 2020 Q1 | 374 534.27 € | 10 619.42 € | 5 965.7 € | 3 |