Address

Email address

Phone number

Website

https://teraekspert.eeFirmast - Teraekspert

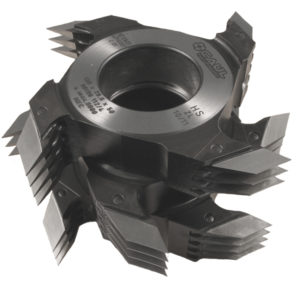

https://teraekspert.eeFirmast - TeraekspertTähtis info – Asume uuel aadressil Savi 5/2 Pärnu 80040, kaart kontaktide lehel. OÜ Teraekspert on 100% eesti kapitalil põhinev ettevõte, mis alustas tegutsemist 1998. aastal Pärnus. Meie põhitegevusalaks on puidulõiketerade müük, tootmine ning hooldus. Ettevõtte eesmärgiks on pakkuda kvaliteetseid puidulõiketerasid ja heal tasemel teenust konkurentsivõimelise hinnaga. Miks tellida lõiketerad Teraekspert OÜst? Pakume täislahendust – […]

Name

osaühing Teraekspert

Registry code

10414961

VAT number

EE100156689

Type

OÜ - Limited Liability Company

Status

Registered

Foundation date

09.04.1998 (27)

Financial year

01.01-31.12

Capital

40 000.00 €

Activity

46749 - Wholesale of hand tools and general hardware

-

-

-

-

-

-

-

No tax arrears

-

-

| Owner | Representative | Beneficial owner | Roles | |

|---|---|---|---|---|

| Urmas Koppel

| 50% - 20 000.00 EUR | Board member | - | |

| Jaanis Köster

| 25% - 10 000.00 EUR | - | - | |

| Omanikukonto: AIRI KOPPEL

| 25% - 10 000.00 EUR | - | - |

| Turnover | State taxes | Labor taxes and payments | Employees | |

|---|---|---|---|---|

| 2024 Q4 | 197 612.85 € | 32 347.22 € | 13 704.28 € | 5 |

| 2024 Q3 | 187 799.85 € | 32 750.69 € | 12 801.1 € | 5 |

| 2024 Q2 | 308 379.6 € | 35 636.57 € | 12 049.17 € | 5 |

| 2024 Q1 | 168 708.08 € | 27 053.02 € | 11 964.46 € | 4 |

| 2023 Q4 | 202 246.36 € | 40 514.29 € | 13 895.69 € | 4 |

| 2023 Q3 | 194 454.45 € | 30 532.85 € | 12 973.03 € | 5 |

| 2023 Q2 | 341 600.2 € | 33 003.79 € | 13 899.06 € | 5 |

| 2023 Q1 | 169 068.06 € | 12 660.79 € | 9 802.83 € | 4 |

| 2022 Q4 | 269 214.44 € | 34 243.47 € | 11 773.48 € | 4 |

| 2022 Q3 | 247 101.01 € | 35 086.83 € | 12 554.73 € | 4 |

| 2022 Q2 | 300 273.39 € | 28 783.57 € | 10 697.66 € | 5 |

| 2022 Q1 | 253 989.96 € | 34 371.75 € | 10 106.58 € | 5 |

| 2021 Q4 | 260 778.99 € | 34 052 € | 10 879.88 € | 5 |

| 2021 Q3 | 299 765.48 € | 32 940.01 € | 11 311.89 € | 5 |

| 2021 Q2 | 278 351.38 € | 39 070.44 € | 11 904.38 € | 5 |

| 2021 Q1 | 218 170.12 € | 27 532.04 € | 9 152.23 € | 5 |

| 2020 Q4 | 244 749.17 € | 30 460.1 € | 10 500.77 € | 5 |

| 2020 Q3 | 193 264.08 € | 25 657.86 € | 9 674.51 € | 5 |

| 2020 Q2 | 216 357.74 € | 28 114.56 € | 9 726.11 € | 5 |

| 2020 Q1 | 208 916.27 € | 30 037.25 € | 9 914.19 € | 5 |