Address

Email address

Phone number

https://hades.eeHades Geodeesia

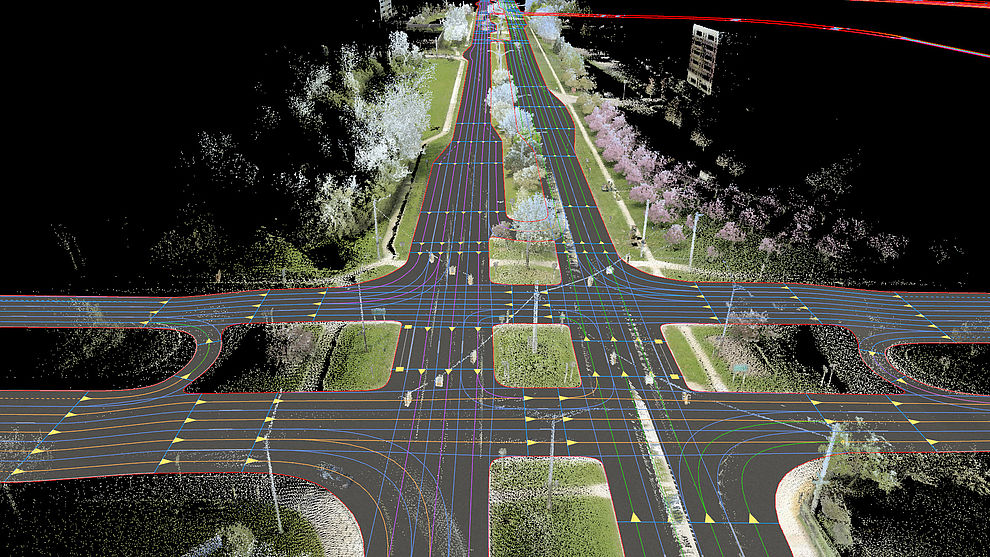

https://hades.eeHades GeodeesiateenusedPAKUTAVAD TEENUSEDEHITUSGEODEESIAProfessionaalne ehitusgeodeesia ja ehitusmõõdistamine Eestis. Täpsed mõõtmised ja usaldusväärsed geodeetilised teenused ehitusprojektide edukaks läbiviimiseks.Loe lähemaltGEODEETILINE ALUSPLAANGeodeetiline alusplaan kujutab endas mõõdistatud maa-ala kaarti, mis edastab maapealse asendiplaanilise situatsiooni koos tehnovõrkude paiknemisega.Loe lähemaltTEOSTUSMUDELTeostusmudel võimaldab kontrollida valminud või valmimas ehitist projekteerituga. Ehitusaegne…

Name

Osaühing Hades-Invest

Registry code

10262008

VAT number

EE100379411

Type

OÜ - Limited Liability Company

Status

Registered

Foundation date

12.09.1997 (27)

Financial year

01.01-31.12

Capital

3 258.00 €

Activity

46699 - Wholesale of other general-purpose and special-purpose machinery, apparatus and equipment 71122 - Construction geological and geodetic research

-

-

-

-

-

-

-

No tax arrears

-

-

| Owner | Representative | Beneficial owner | Roles | |

|---|---|---|---|---|

| Madis Mölla

| 33% - 1 086.00 EUR | Board member | - | Founder |

| Tiit Hion

| 33% - 1 086.00 EUR | Board member | - | Founder |

| Tiiu Kütt

| 33% - 1 086.00 EUR | - | - | |

| Koit Mölla

| - | - | - | Founder |

| Owner | Representative | Beneficial owner | Roles | |

|---|---|---|---|---|

| Osaühing Hadwest 10500844 | 50% - 9 587.00 EUR | - | - | Founder |

| OÜ Hades Geodeesia 10570307 | 42% - 1 621.00 EUR | - | - | |

| Osaühing GEOinstrument 12731246 | 50% - 1 250.00 EUR | - | - | Founder |

| Turnover | State taxes | Labor taxes and payments | Employees | |

|---|---|---|---|---|

| 2024 Q4 | 150 545.78 € | 24 767.56 € | 9 470.88 € | 5 |

| 2024 Q3 | 196 422.03 € | 37 723.01 € | 9 275.06 € | 5 |

| 2024 Q2 | 101 910.12 € | 16 833.57 € | 9 699.26 € | 5 |

| 2024 Q1 | 150 798.44 € | 25 016.8 € | 10 658.33 € | 5 |

| 2023 Q4 | 78 565.03 € | 16 096.09 € | 9 162.28 € | 5 |

| 2023 Q3 | 237 062.01 € | 37 813.91 € | 10 141.18 € | 5 |

| 2023 Q2 | 152 282.31 € | 28 692.82 € | 9 074.66 € | 5 |

| 2023 Q1 | 95 043.68 € | 20 628.86 € | 10 039.62 € | 5 |

| 2022 Q4 | 148 686.9 € | 28 796.06 € | 9 002.19 € | 5 |

| 2022 Q3 | 94 996.5 € | 19 951.47 € | 10 856.24 € | 5 |

| 2022 Q2 | 247 288.07 € | 39 082.03 € | 8 937.03 € | 5 |

| 2022 Q1 | 261 641.94 € | 35 584.84 € | 9 287.92 € | 5 |

| 2021 Q4 | 127 779.7 € | 19 744.07 € | 8 507.39 € | 5 |

| 2021 Q3 | 197 720.84 € | 28 837.62 € | 8 833.09 € | 5 |

| 2021 Q2 | 196 176.11 € | 26 482.02 € | 7 949.21 € | 5 |

| 2021 Q1 | 69 246.28 € | 14 702.82 € | 8 732 € | 5 |

| 2020 Q4 | 121 086.79 € | 22 988.04 € | 8 046.46 € | 5 |

| 2020 Q3 | 76 312.6 € | 16 982.06 € | 8 584.56 € | 5 |

| 2020 Q2 | 166 023.8 € | 29 603.47 € | 7 509.41 € | 5 |

| 2020 Q1 | 128 635.72 € | 12 871.63 € | 8 336.15 € | 5 |